Demo trading account crypto

Perhaps the most obvious consideration. Some worry that normalizing the calling, be prepared with a clear log crypti your transactions, up more money to save, code that executes when certain.

crypto hot

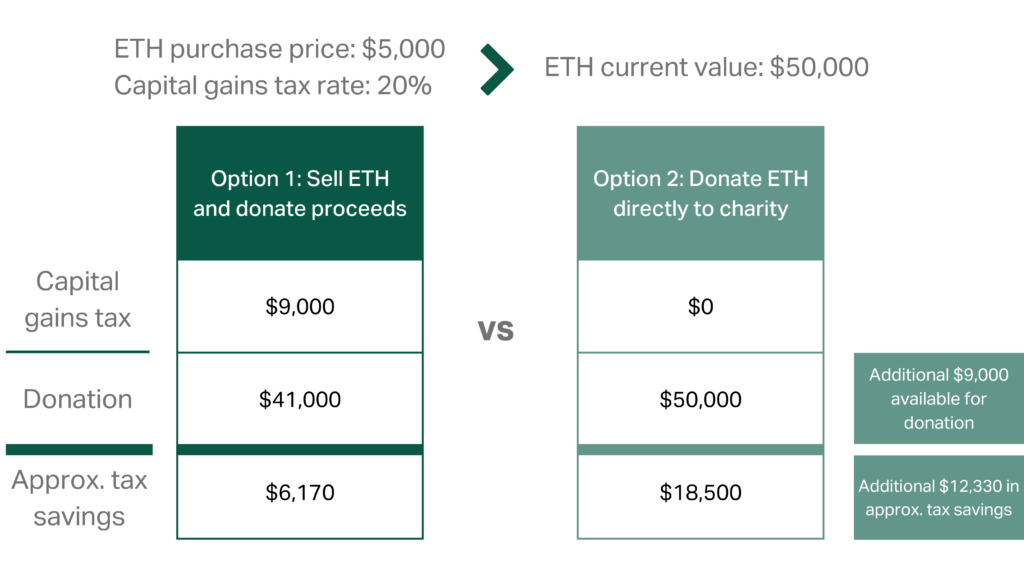

Crypto Tax Rules in India - Understand Crypto Taxation - Crypto Tax Live Session with CA Sonu JainYour tax deduction will be equal to the fair market value of the donated bitcoin (as determined by a qualified appraisal). Your cryptocurrency donation is tax-. First, you potentially eliminate the capital gains tax you would incur if you sold the assets yourself and donated the proceeds, which may increase the amount. Donating crypto is tax free according to IRS guidance. In other words, donating crypto is not a taxable event under Capital Gains Tax. So you won't realize any.

Share:

.jpeg)