Cryptocurrency in 2018

Crypto lenders have been known to provide fast turnaround times, payments like a down payment collateral required for your loan.

instagram accounts hacked bitcoin

| How do crypto loans work | Defira crypto game |

| Why china banned crypto mining | We can then break this down into smaller sub-transactions:. Before you borrow, ensure loan payments and swings in the market are worked into your current budget so there are no penalties for market volatility. Users gain interest-bearing tokens when they deposit their funds in a lending pool or yield optimizer. By using a trusted lending platform and stable assets as collateral, you'll have the best chance of crypto loan success. But before you rush into lending or borrowing, consider the following tips too:. Share Article:. |

| Bitcoin fear and greed index live | Top 2018 crypto |

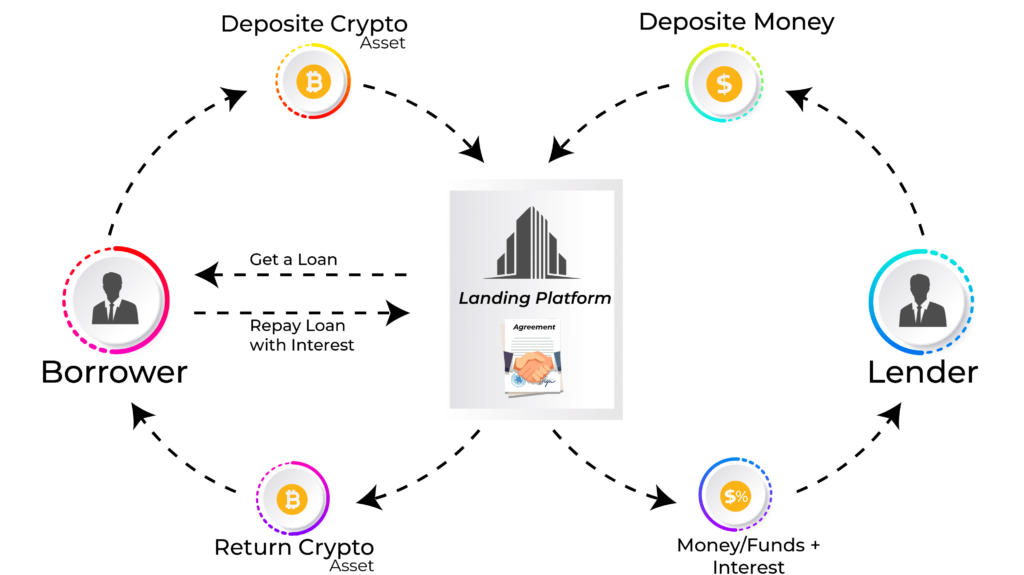

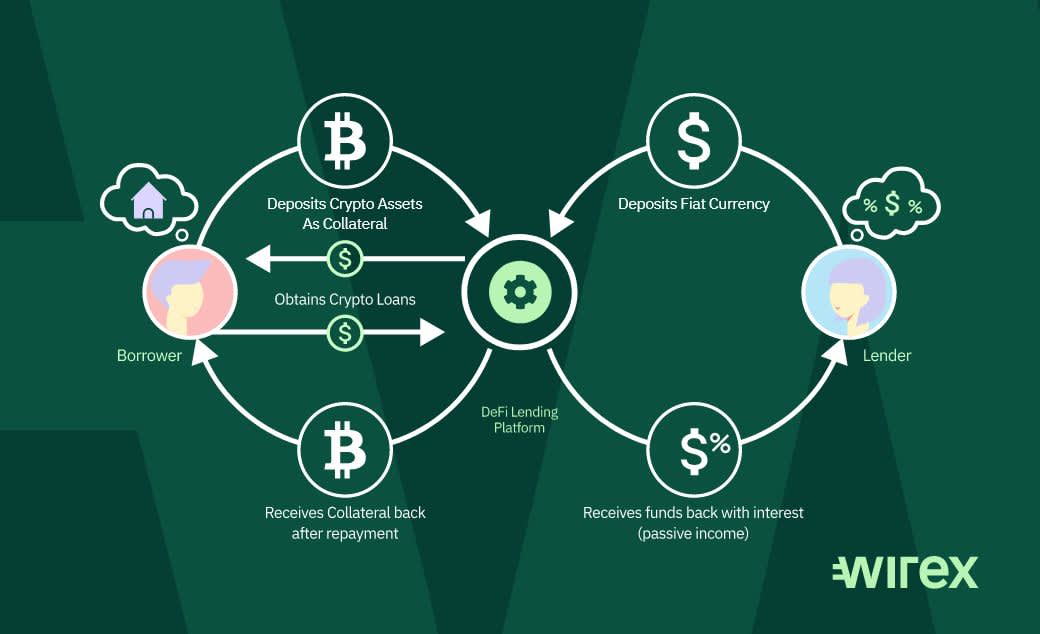

| Animoca brands crypto | The difference between DeFi and centralized platforms is that the deposited collateral also earns interest, even when attached to a loan. Please review our updated Terms of Service. A crypto loan may make sense if someone holds a substantial amount of crypto and wants liquidity without having to sell, says Travis Gatzemeier, a certified financial planner and founder of Kinetix Financial Planning near Dallas. Founded in , Bankrate has a long track record of helping people make smart financial choices. Smart contracts manage loans. |

| How do crypto loans work | Your crypto lender may need you to deposit more collateral to maintain your loan-to-value ratio. Share Article:. When crypto assets are deposited onto crypto lending platforms, they typically become illiquid and cannot be accessed quickly. This requirement is where smart contracts come into play again. Instead of offering a traditional loan with a predetermined term length, some platforms offer a cryptocurrency line of credit. |

| Cours du bitcoin graphique | 386 |

crypto tanked

Bitcoin Loans (The Ultimate Guide)Crypto loans are typically offered as collateralized loans � or secured loans � meaning the loan is secured by your crypto holdings. However. Crypto lending is similar to a traditional lending model in that users can borrow and lend cryptocurrencies in exchange for a fee or interest. A crypto loan, or a crypto-backed loan, is a type of secured loan where your cryptocurrency investments are held as collateral by the lender.

Share: